Investors look into the SEC filings for smart investments. Here, the organisational insiders, as well as the broker-dealers, get indulged in the submission of periodic financial statements and other types of business account disclosures. In addition, the specified financial professionals and investors of several business organisations. Rely on the SEC filings to support their informed decisions regarding the evaluation of ideas of investments in a business organisation.

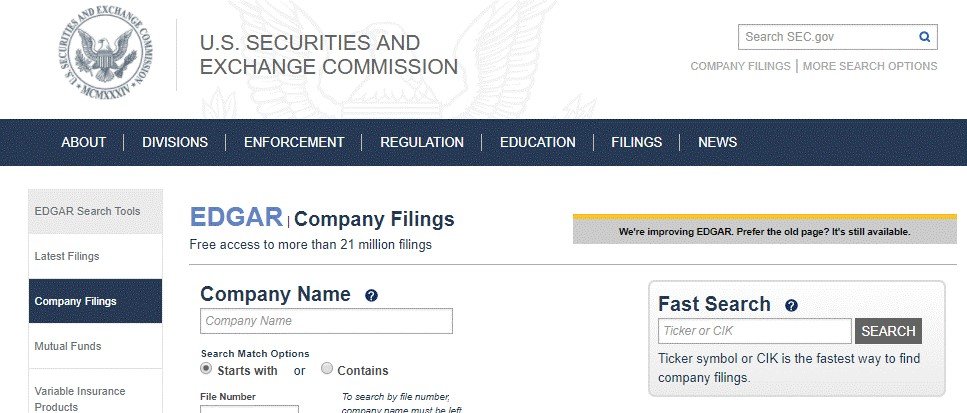

The filings can be done at the Security and Exchange Board of the USA and can be filed and accessed at EDGAR. It is the commission’s robust and free online database platform where all the files of small and medium-scale businesses. The term EDGAR stands for “Electronic Data Gathering, Analysis and Retrieval”. It helps the registered business organisation to boost the working procedure embedded with accessibility and efficiency of corporate filings.

Under the Securities Act of 1933, the public business organisations of the USA, are used to publish their financial data at the end of the fiscal year. Some small-scale business organisations have also been on the verge of releasing their financial data quarterly. Therefore, it was not possible for every investor to check each financial data of the organisations, and that is why the US government has opted for such type of online platform.

The registration statements play an important role regarding the filings of business organisations in the digital platform. When a business organisation plans to odder the securities to the public, the Form S-1 registration statement with the Securities and Exchange Commission is important. The statement mainly consists of two vital parts, which are Prospectus and Additional information.

The prospectus is one of the mandatory documents for filing, which has to give to the specified person who has decided to purchase the securities of a business organisation. The prospectus has all the details of the organisation’s managerial operations, business operations, financial results, operational results, factors related to risk, information regarding patents, and many more.

The filings of all the small, medium or maybe large-scale business organisation has been mandated by the Securities Act of 1933, where all the small-scale business organisations at that time were eager to raise capital for their business. In addition, after the filings of the small-scale business organisations in the USA, the audit of the income or financial statement has been done by an independent “certified public accountant”.

Considering the additional information, in the process of filing, the business organisation could add other relevant information regarding the business, such as the sales of unregistered securities that were yet to be registered.

Coming to the consideration of the EDGAR database, if you are on to the filing of all the important documents in the public online platform, you can include them in the form of annual or quarterly processes. In case your business organisation falls below the thresholds of transactions in the USA, then you might not be eligible for filing in the EDGAR online database platform.